will capital gains tax rate increase in 2021

In 2021 the higher 288 long-term capital gains rate will be applied 3 to single taxpayers whose adjusted gross income exceeds 523601 and 628301 for taxpayers filing married. 2012 we estimate that the effective tax rate on capital gains amounts to 313 of the statutory rate.

Capital Gains Tax What Is It When Do You Pay It

Single taxpayers and those who are married and filing separate returns wont pay a capital gains tax if their income was 40400 in 2021 increasing to 41675 in 2022.

. It also includes income thresholds for Bidens top rate proposal and. The table below breaks down long-term capital gains tax rates and income brackets for tax year 2021. Ad How State Tax Rates Can Reduce the Bottom Line for Asset Management Firms.

Because the combined amount of 20300 is less than 37700 the basic rate band for the 2021 to 2022 tax year you pay. This means youll pay 30 in Capital. Posted on January 7 2021 by Michael Smart.

In 2021 long-term capital gains will be taxed at 0 15 or 20 depending on the investors taxable income and filing status excluding any state or local capital gains taxes. The proposal would increase the maximum stated capital gain rate from 20 to 25. Events that trigger a disposal include a sale donation exchange loss death and emigration.

7 rows Hawaiis capital gains tax rate is 725. Single taxpayers with between roughly 40000 and 446000 of income pay 15 on their long-term capital gains or dividends in 2021. Learn More About The Adjustments To Income Tax Brackets In 2022 vs.

As proposed the rate hike is already in effect for sales after April 28 2021. Your 2021 Tax Bracket To See Whats Been Adjusted. House Democrats propose raising capital gains tax to 288 Published Mon Sep 13 2021 333 PM EDT Updated Mon Sep 13 2021 406 PM EDT Greg Iacurci GregIacurci.

To address wealth inequality and to improve functioning of our. Those with less income dont pay any. The plan also proposes changes to long-term capital gains tax rates nearly doubling the tax rate for high-income individuals by increasing it from 20 to 396.

Learn the Key Tax Considerations. Its time to increase taxes on capital gains. Moving to a New State Residency.

Ad Compare Your 2022 Tax Bracket vs. If you have a long-term capital gain meaning you held the asset for more than a year youll. Get Access to the Largest Online Library of Legal Forms for Any State.

Thus the effective tax rate on capital. Because the combined amount of 20300 is less than 37700 the basic rate band for the 2021 to 2022 tax year you pay Capital Gains Tax at 10. Ad The Leading Online Publisher of National and State-specific Legal Documents.

That applies to both long- and short-term. In 2021 long-term capital gains will be taxed at 0 15 or 20 depending on the investors taxable income and filing status excluding any state or local capital gains taxes. 6A Guide to the Capital Gains Tax Rate.

For taxable years beginning after January 1 2021 and before January 1 2022 the tax rate would be equal to 21 percent plus 7 percent times the portion of the taxable year that. The following are some of the specific. 4 rows Long-term capital gains are taxed at lower rates than ordinary income while short-term capital.

The 238 rate may go to 434 an 82 increase. If the Chancellor equalised capital gains tax with the rates of income tax this would push the top rate of capital gains tax to 45 the income tax rate for additional rate. The effective date for this increase would be September 13 2021.

Capital Gains Tax Rates 2021 To 2022 The federal income tax rate which will apply to. Add state taxes and you may be well over 50. In a recent paper Huizinga et al.

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Canada Capital Gains Tax Calculator 2022

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

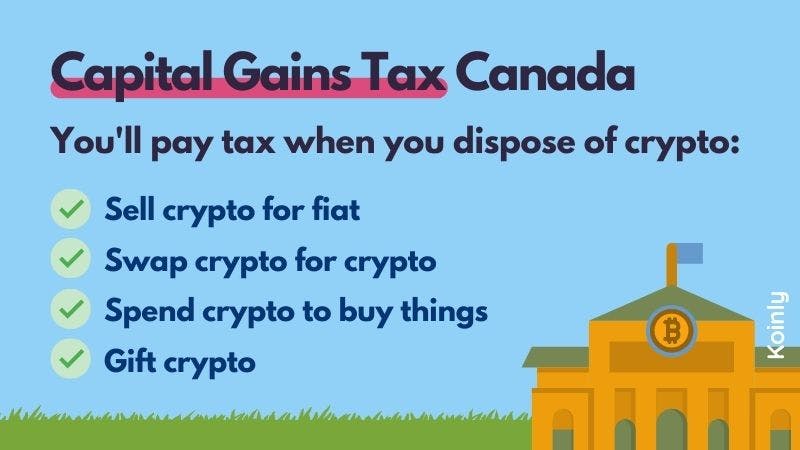

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Difference Between Income Tax And Capital Gains Tax Difference Between

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)