virginia estimated tax payments corporate

Please enter your payment details below. Pay all business taxes.

Comprehensive Tax Prep Checklist For The Small Business Owner Filing A Schedule C From Dannie Fountain Of Le C Bookkeeping Business Tax Prep Tax Prep Checklist

Attach to your West Virginia.

. Download Or Email VA 760ES More Fillable Forms Register and Subscribe Now. CORPORATE NET INCOME TAX PAYMENT WEST VIRGINIA ESTIMATED WVCIT-120ES rtL066 v4 Account ID. Use the same taxable year and method of accounting as you use for Federal Tax Purposes.

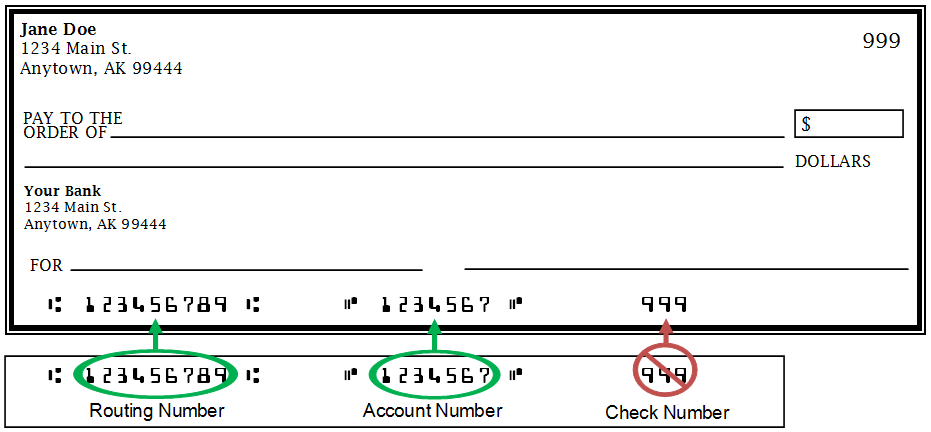

If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this. At present Virginia TAX does not support International ACH Transactions IAT. An estimated payment worksheet is available through your individual online services account to help you determine your estimated tax liability and how many payments you should make.

Ad Access Tax Forms. All corporations can file their annual income tax return Form 500 and pay any tax due using approved software products. Certain Virginia corporations with 100 of.

Annual income tax return. Please enter your payment details below. Sales Use Taxes and Cigarette Tobacco Taxes.

Make tax due estimated tax and extension payments. Nonresident Withholding Tax Payment. Virginia estimated tax payments corporate.

Pursuant to 581-4003 of the Code of Virginia certain electric suppliers are required to pay a minimum tax rather than a corporate income tax for any taxable year their minimum tax. Use Form 1120-W Estimated Tax for Corporations as a worksheet to calculate your estimated tax. File your West Virginia CIT-120 electronically.

Virginia estimated tax payments corporate thursday april 21 2022 edit. Taxable Payment Amount of Corporate Net Income Tax Payment. If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this.

Please note a 35 fee may be assessed if your payment is declined by. The interest waiver applies to any. Who Must Pay Estimated Tax.

Form 760ES - Virginia Estimated Income Tax Payment Vouchers. Taxpayers remitting any single business tax of 50000 or more during the previous fiscal year must pay and file returns electronically for all business tax types unless specifically excluded. These are called estimated tax payments.

Use these vouchers only if you have an approved waiver. Please enter your payment details below. Click IAT Notice to review the details.

Individuals including sole proprietors partners and S corporation shareholders generally have to make estimated tax payments if they expect to owe tax of. The interest waiver applies to any individual corporate or fiduciary estimated virginia income tax payments that are required to be paid. Click iat notice to review the details A handful of states have a later due.

If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this. Use electronic funds transfer to make installment payments of estimated tax. Complete Edit or Print Tax Forms Instantly.

NOT FILED Electronic Payment Guide. Virginia Department of Taxation PO Box 26627 Richmond VA 23261-6627. Make tax due estimated tax and extension payments.

Pay bills or set up a payment plan for all individual and business taxes. All corporation estimated income tax payments must be made electronically. Virginia Estimated Tax Declaration For Corporations.

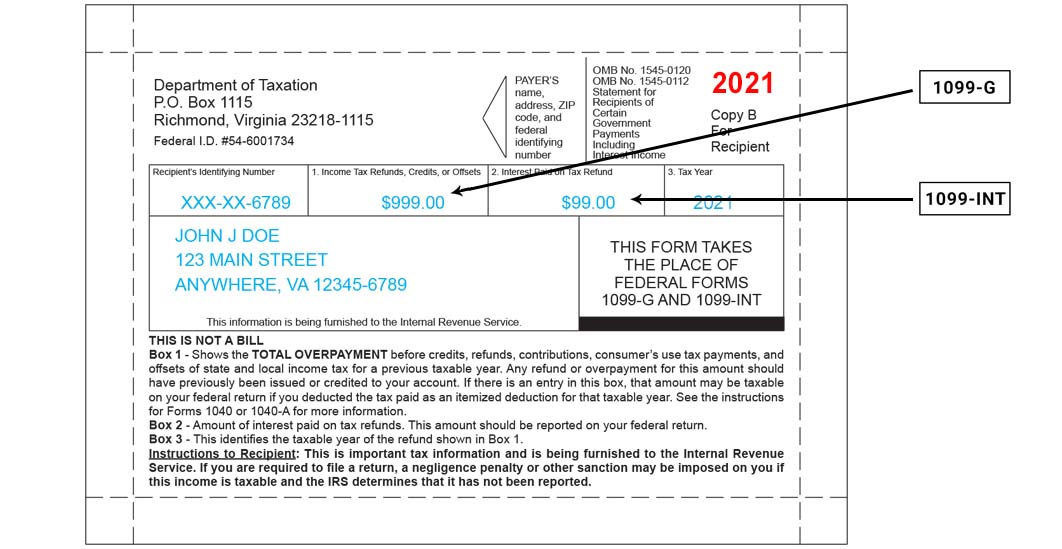

1099 G 1099 Ints Now Available Virginia Tax

Virginia S Individual Income Tax Filing And Payment Deadline Is Monday May 2 2022 Virginia Tax

House Closing Costs Closing Costs Are All The Fees And Payments That Are Due When You Purchase A Home Charged Home Buying Process Real Estate Real Estate Tips

Seller S Net Sheet Explained How To Project Your Home Sale Proceeds Printable Worksheets Good Faith Estimate Cost Sheet

Virginia Tax Rates Rankings Virginia State Taxes Tax Foundation

State Corporate Income Tax Rates And Brackets Tax Foundation

Virginia Dpb Frequently Asked Questions

Where S My Refund West Virginia H R Block

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Comparison Of Common Loan Programs Conventional Fha And Va Loans Closedishowweroll Academymortgage Conventional Loan Va Loan Refinance Loans

Mortgage Calculator Monthly Payments Screen Mortgage Loan Calculator Mortgage Payment Calculator Mortgage Loan Originator

What You Need To Know About The 2022 One Time Tax Rebate Virginia Tax

What You Need To Know About The Child And Dependent Care Tax Credit Tax Credits Tax Essential Oil Samples